charitable gift annuity canada

Make your legacy one of compassion. In exchange the charity assumes a legal obligation.

Gift Estate Planning Sfu Advancement Alumni Engagement

A charitable tax receipt for the.

. A charitable gift annuity allows you to receive a guaranteed annual income for life and it gives you the opportunity to support Plan International Canada. Benefits of a Charitable Gift Annuity. Ad Support our mission while your HSUS charitable gift annuity earns you income.

Ad Support our mission while your HSUS charitable gift annuity earns you income. It can be especially appealing. Better return than is currently possible through a GIC or Bond.

A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. A donor makes a sizeable contribution to a charity using cash securities or other. A portion of your donation will be used to purchase a commercial annuity from an insurance company that will pay the amount promised.

A Charitable Gift Annuity is a gift vehicle that when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime. Give And Gain With CMC. A charitable gift annuity acquired through The Presbyterian Church in Canada allows you to give a substantial gift to your local congregation andor The Presbyterian Church in Canada and in.

A charitable gift annuity is an agreement under which you donate a capital sum to a registered charity and in return the charity guarantees you regular payments. A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity. You love helping animals.

One widely overlooked strategy deserves special attention from generous baby boomers and other individuals who want to reduce their taxes -- make a significant gift to a charity and. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. A charitable gift annuity is a contract between a donor and a charity with.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. It is a thoughtful gift that gives back. You love helping animals.

Safe secure stream of income that is largely tax-exempt. Ad Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor another person or.

Give And Gain With CMC. It is an arrangement where you transfer. Ad Annuities are often complex retirement investment products.

Link Charity is the number one distributor of charitable annuities Canada. A charitable gift of annuity is a contract between a donor and a charity with a specific set of terms. A Charitable Gift Annuity might be right for you.

Ad Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Make your legacy one of compassion.

Learn some startling facts. At Link Charity we specialize in Charitable Gift Annuities with a higher than average investment income to. A Charitable Gift Annuity is a gift vehicle and when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime.

The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of Charitable Gift. Earn Lifetime Income Tax Savings. Link Charity is the number one distributor of charitable annuities Canada-wide because they are the only company that allows you to gift your annuity to as many charities as you wish.

Earn Lifetime Income Tax Savings.

Charitable Gift Annuity Partners In Health

Charitable Gift Annuities Ppcli Foundation

Charitable Annuity Charitable Gift Annuities Lifeannuities Com

Charitable Gifting Strategies As A Tax And Financial Planning Tool Canada Gives

Charitable Gift Annuities Studentreach

Charitable Gift Annuities Give To Ualberta

Good Health Is Wealth Annuities As Well As Tax Obligation Annuity Tax Tax Money

Cga Funded With Appreciated Assets Gfa World

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

Charitable Gift Annuity The Christian School Foundation

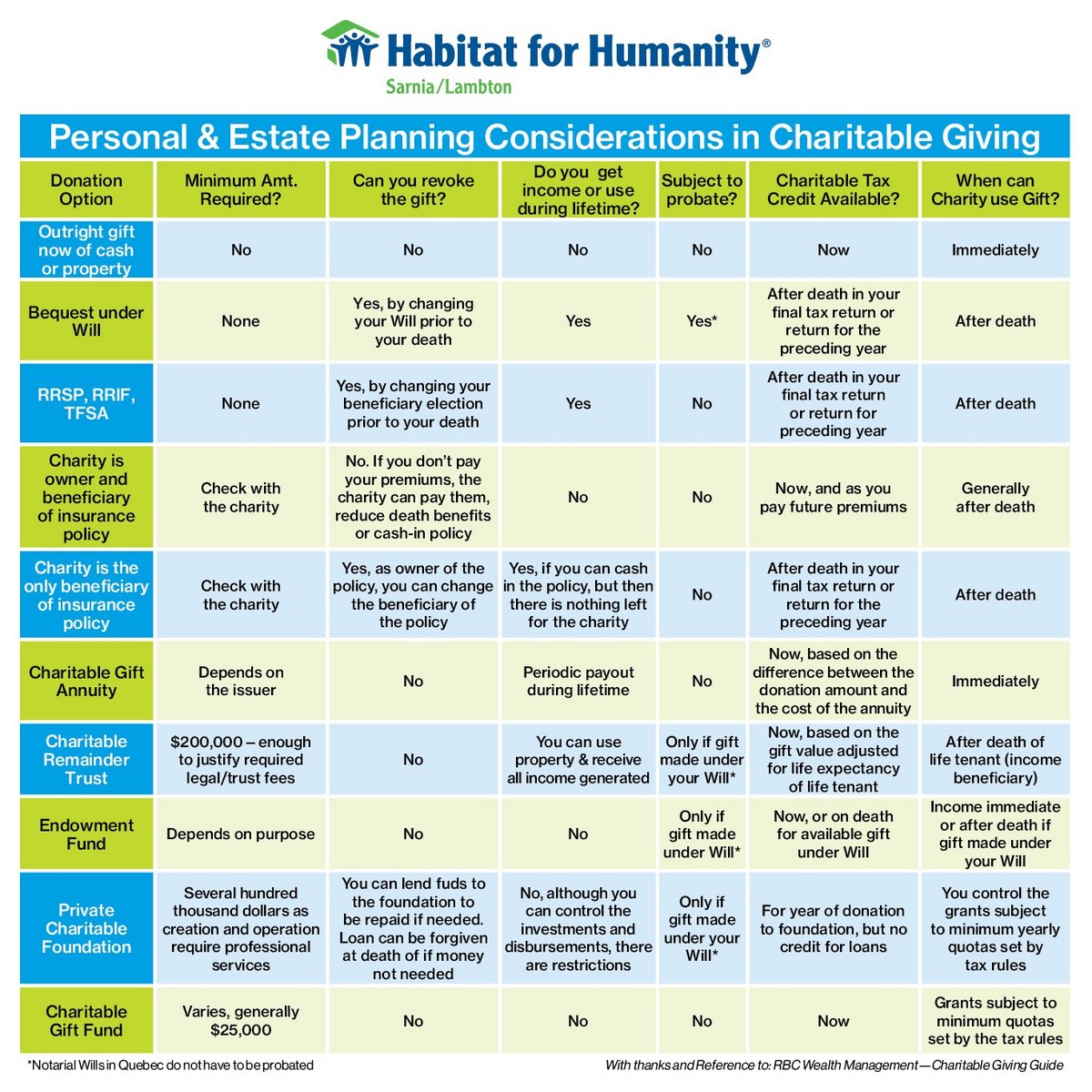

Planned Giving Habitat For Humanity Sarnia Lambton

Charitable Gift Annuities Citadel Foundation

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Charitable Gift Annuity Village Missions

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

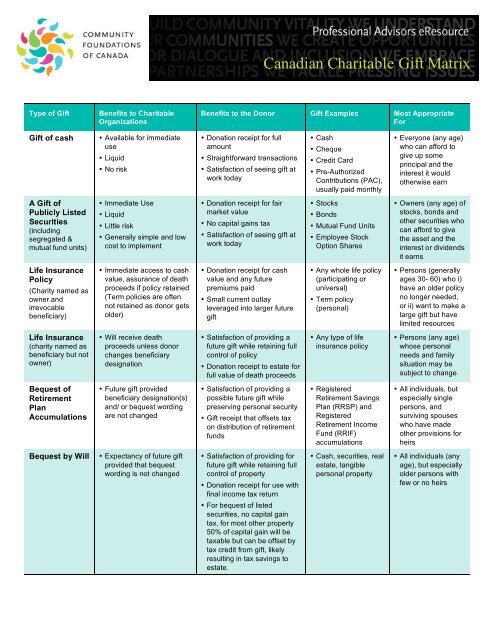

Canadian Charitable Gift Matrix Community Foundations Of Canada

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust